Two weeks after Washington's latest showdown, more than half of economists surveyed by USA TODAY -- 56% -- are less optimistic about growth prospects than they were three months ago. The survey of 41 top economists was conducted Oct. 23-24.

What's more, repeated budget battles in Washington the past few years are having a cumulative effect. Sixty-three percent of the economists say the recurring standoffs are hurting the economy "some" or "a lot." The remainder cite "a little" damage.

"We're falling down a fiscal flight of stairs and we're bouncing from one step to the next, one crisis to the next," says Sean Snaith, an economist at the University of Central Florida. Snaith is among the economists who have turned less optimistic, saying uncertainty among businesses could persist into next year and dampen capital spending.

Lawmakers on Oct. 16 agreed to fund the government until mid-January and raise the nation's borrowing authority until early February, which sets the stage for another battle early next year. The recent episode and lingering fears of a stomach-churning rerun helped lead the economists surveyed to lower their forecasts.

They now expect the economy to grow at a tepid 2.1% annual rate in the fourth quarter and 2.6% in the first quarter, down from their median estimates three months ago of 2.6% and 2.8%, respectively.

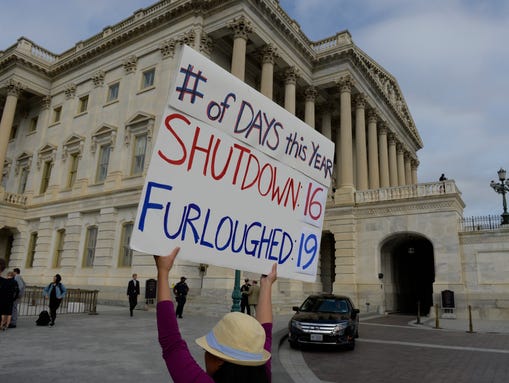

A federal employee protests outside the Capitol on Wednesday.(Photo: H. Darr Beiser, USA TODAY)

Job growth, which began the year at a brisk monthly pace of about 200,000 before slowing to 143,000 in the third quarter, isn't expected to rev back up! to a 200,000 rate until the third quarter. Previously, they had targeted the second quarter.

At least partly as a result of the ongoing budget drama, most of the economists don't expect the Federal Reserve to begin scaling back its bond-buying stimulus until next year. Twenty-three percent say the tapering will begin in January, and 40% picked March. Fed policymakers meet Tuesday and Wednesday but economists don't expect them to take any significant action.

Top Casino Companies To Own In Right Now

At least some economists say the upcoming battle has a better chance of producing a short-term compromise with less down-to-the-wire drama after polls showed the recent episode tarnished Republicans' image. Michael Hanson, senior U.S. economist for Bank of America, expects a "status quo" deal among lawmakers that lasts three to 11 months. He thinks the agreement will maintain the current level of spending cuts, known as sequestration, and avoid longer-term reductions to entitlements, such as Social Security.

Hanson says that, along with a strengthening private sector, should be enough to propel the economy to a 3%-plus rate of growth and more than 200,000 monthly job gains by mid-year — a forecast that reflects the economists' median estimates.

Several economists noted that, more than four years into the recovery, the economy remains poised to accelerate from its listless pace — regardless of Washington's budget skirmishes. Household debt levels are at 30-year lows, the housing recovery is picking up steam, stocks are near all-time-highs and bank-lending standards are easing for both consumers and businesses. And corporate America may be growing wise to political theatrics that inevitably result in 11th-hour deals to avert crises.

"A lot of the business leaders I've spoken to have come away realizing that they can begin to tune out some of the rancor in Washington and focus on ! the stren! gth of the private economy," says Bernard Baumohl, chief economist of The Economic Outlook Group.

No comments:

Post a Comment