DELAFIELD, Wis. (Stockpickr) -- Short-sellers hate being caught short a stock that reports a blowout quarter. When this happens, we often see a tradable short squeeze develop as the bears rush to cover their positions to avoid big losses. Even the best short-sellers know that it's never a great idea to stay short once a bullish earnings report sparks a big short-covering rally.

>>5 Stocks Ready to Break Out

This is why I scan the market for heavily shorted stocks that are about to report earnings. You only need to find a few of these stocks in a year to help enhance your portfolio returns -- the gains become so outsized in such a short time frame that your profits add up quickly.

That said, let's not forget that stocks are heavily shorted for a reason, so you have to use trading discipline and sound money management when playing earnings short-squeeze candidates. It's important that you don't go betting the farm on these plays and that you manage your risk accordingly. Sometimes the best play is to wait for the stock to break out following the report before you jump in to profit off a short squeeze. This way, you're letting the trend emerge after the market has digested all of the news.

>>5 Rocket Stocks Worth Buying This Week

Of course, sometimes the stock is going to be in such high demand that you risk missing a lot of the move by waiting. That's why it can be worth betting prior to the report -- but only if the stock is acting technically very bullish and you have a very strong conviction that it is going to rip higher. Just remember that even when you have that conviction and have done your due diligence, the stock can still get hammered if The Street doesn't like the numbers or guidance.

If you do decide to bet ahead of a quarter, then you might want to use options to limit your capital exposure. Heavily shorted stocks are usually the names that make the biggest post-earnings moves and have the most volatility. I personally prefer to wait until all the earnings-related news is out for a heavily shorted stock and then jump in and trade the prevailing trend.

>>3 Big Stocks on Traders' Radars

With that in mind, here's a look at several stocks that could experience big short squeezes when they report earnings this week.

Bio-Reference Laboratories

My first earnings short-squeeze play is laboratory testing services player Bio-Reference Laboratories (BRLI), which is set to release numbers on Thursday before the market open. Wall Street analysts, on average, expect Bio-Reference Laboratories to report revenue of $191.45 million on earnings of 43 cents per share.

>>5 Stocks Breaking Out on Big Volume

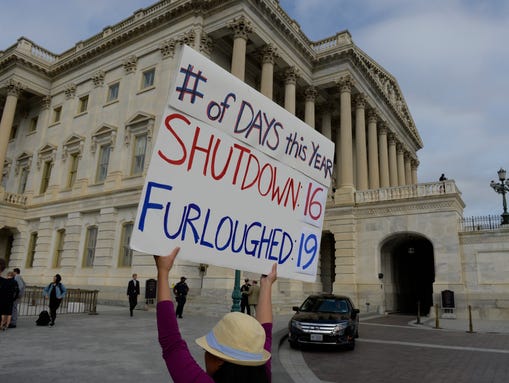

This company recently slashed its profit guidance for the quarter and the year, citing the government shutdown and the transitions under the Affordable Care Act disrupted business, as did changes in reimbursements from both public and private insurers.

The current short interest as a percentage of the float Bio-Reference Laboratories is extremely high at 36.3%. That means that out of the 24.44 million shares in the tradable float, 9.59 million shares are sold short by the bears. This is a huge short interest on a stock with a very low tradable float. Any bullish earnings news could easily spark a monster short-squeeze for shares of BRLI post-earnings.

From a technical perspective, BRLI is currently trending below both its 50-day and 200-day moving averages, which is bearish. This stock has been downtrending badly over the last month, with shares moving lower from its high of $37.97 to its recent low of $26.12 a share. During that downtrend, shares of BRLI have been consistently making lower highs and lower lows, which is bearish technical price action. That move has now pushed shares of BRLI into oversold territory, since its current relative strength index reading is 28.48.

If you're bullish on BRLI, then I would wait until after its report and look for long-biased trades if this stock manages to take out its 200-day moving average of $28.72 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 311,738 shares. If we get that move, then BRLI will set up to re-test or possibly take out its 50-day moving average at $31.91 a share. Any high-volume move above $31.91 will then give BRLI a chance to re-test its recent gap down day high of $35 a share.

I would simply avoid BRLI or look for short-biased trades if after earnings it fails to trigger that move and then drops back below some key near-term support levels at $26.12 to $25.38 a share with high volume. If we get that move, then BRLI will set up to re-test or possibly take out its next major support level at its 52-week low of $23.36 a share. Any high-volume move below $23.36 will then give BRLI a chance to trend back below $20 a share.

AAR

Another potential earnings short-squeeze trade idea is aviation services and products player AAR (AIR), which is set to release its numbers on Thursday after the market close. Wall Street analysts, on average, expect AAR to report revenue $536.14 million on earnings of 48 cents per share.

>>5 Big Trades for Year-End Gains

The current short interest as a percentage of the float for AAR is notable at 6.5%. That means that out of the 36.40 million shares in the tradable float, 2.42 million shares are sold short by the bears. The bears have also been increasing their bets from the last reporting period by 31.3%, or by about 576,000 shares. If the bears get caught pressing their bets into a strong quarter, then shares of AIR could easily rip sharply higher post-earnings as the bears rush to cover some of their short positions.

From a technical perspective, AIR is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been uptrending strong for the last six months, with shares moving higher from its low of $20.76 to its recent high of $31.55 a share. During that uptrend, shares of AIR have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of AIR within range of triggering a big breakout trade post-earnings.

If you're in the bull camp on AIR, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $31 to its 52-week high at $31.55 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 295,734 shares. If that breakout hits, then AIR will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $40 to $45 a share.

I would simply avoid AIR or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below its 50-day moving average of $29.43 a share to more near-term support at $29.02 a share with high volume. If we get that move, then AIR will set up to re-test or possibly take out its next major support levels at $27 to $26 a share. Any high-volume move below those levels will then set up AIR to re-test or possibly take out its 200-day moving average of $23.83 a share.

Darden Restaurants

One potential earnings short-squeeze candidate is full service restaurant player Darden Restaurants (DRI) which is set to release numbers on Thursday before the market open. Wall Street analysts, on average, expect Darden Restaurants to report revenue of $2.07 billion on earnings of 21 cents per share.

>>4 Hot Stocks to Trade (or Not)

Just today, Activist hedge fund Barington Capital Group issued a report arguing that Darden Restaurants could be worth $71 to $80 a share if the company enacts a series of strategic changes. Those changes would be Darden splitting into two companies – one for Olive Garden and Red Lobster, and the other for its higher-growth brands, including LongHorn Steakhouse, Capital Grille, Yard House and Bahama Breeze. The firm also recommends Darden explore creating a publicly traded real estate investment trust.

The current short interest as a percentage of the float for Darden Restaurants stands at 6%. That means that out of the 129.46 million shares in the tradable float, 8.3 million shares are sold short by the bears. If this company can deliver the earnings news the bulls are looking for, then shares of DRI could easily explode sharply higher post-earnings as the bears jump to cover some of their short bets.

From a technical perspective, DRI is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been trending sideways and consolidating for the last two months, with shares moving between $50.69 on the downside and $54.08 on the upside. Shares of DRI have now started to bounce higher off its 50-day moving average of $52 and it's quickly moving within range of triggering a big breakout trade above the upper-end of its recent range.

If you're bullish on DRI, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $54.08 to its 52-week high at $55.25 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 1.90 million shares. If that breakout hits, then DRI will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $60 to $65 a share.

I would avoid DRI or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below some key near-term support levels at $50.69 to its 200-day moving average of $49.69 a share with high volume. If we get that move, then DRI will set up to re-test or possibly take out its next major support levels $46 to $44 a share.

Rite Aid

Another earnings short-squeeze prospect is retail drugstore chain player Rite Aid (RAD), which is set to release numbers on Thursday before the market open. Wall Street analysts, on average, expect Rite Aid to report revenue of $6.32 billion on earnings of 4 cents per share.

>>4 Stocks Rising on Unusual Volume

Just recently, JPMorgan analyst Lisa Gill said the near-term could be somewhat more bumpy for Rite Aid than in recent quarters, citing the economy, reimbursement pressure and ongoing work in executing its turnaround plan.

The current short interest as a percentage of the float for Rite Aid sits at 4.4%. That means that out of the 902.05 million shares in the tradable float, 39.13 million shares are sold short by the bears. If this company can deliver the earnings news the bulls are looking for, then shares of RAD could trend sharply higher post-earning as a sharp short-covering rally takes over.

From a technical perspective, RAD is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been uptrending strong for the last six months, with shares moving higher from its low of $2.62 to its recent high of $6.15 a share. During that uptrend, shares of RAD have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of RAD within range of triggering a big breakout trade post-earnings.

If you're bullish on RAD, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $6 to its 52-week high at $6.15 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 31.18 million shares. If that breakout hits, then RAD will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $7 to $8 a share, or even $9 a share.

I would simply avoid RAD or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below both its 50-day moving average of $5.36 a share with high volume. If we get that move, then RAD will set up to re-test or possibly take out its next major support levels at $5 to $4.50 a share, or even $4 a share.

Cintas

My final earnings short-squeeze play is corporate identity uniforms and related business services provider Cintas (CTAS), which is set to release numbers on Thursday after the market close. Wall Street analysts, on average, expect Cintas to report revenue of $1.12 billion on earnings of 68 cents per share.

The current short interest as a percentage of the float for Cintas is pretty high at 6.9%. That means that out of the 99.88 million shares in the tradable float, 6.69 million shares are sold short by the bears. The bears have also been increasing their bets from the last reporting period by 0.7%, or by 46,000 shares. If the bears get caught pressing their bets into a bullish quarter, then shares of CTAS could soar sharply higher post-earnings as the bears rush to cover some of their short positions.

From a technical perspective, CTAS is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been uptrending strong for the last six month, with shares moving higher from its low of $44.01 to its recent high of $57.99 a share. During that uptrend, shares of CTAS have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of CTAS within range of triggering a big breakout trade post-earnings.

If you're in the bull camp on CTAS, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $55.97 to its 52-week high at $57.99 a share with high volume. Look for volume on that move that hits near or above its three-month average volume of 550,661 shares. If that breakout hits, then CTAS will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $65 to $70 a share.

I would avoid CTAS or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below its 50-day moving average of $53.50 a share to more near-term support at $52.27 a share with high volume. If we get that move, then CTAS will set up to re-test or possibly take out its next major support levels at $49 to its 200-day moving average of $47.86 a share.

To see more potential earnings short squeeze plays, check out the Earnings Short Squeeze Plays portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Under $10 Set to Soar

>>5 Stocks Set to Soar on Bullish Earnings

>>The Truth About Amazon's Drones

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

) offers a dividend yield of 5.02% based on Thursday's closing price of $38.22 and the company's quarterly dividend payout of 48 cents. The stock is up 22% year-to-date. Dividend.com currently rates MO as “Recommended” with a DARS™ rating of 3.5 stars out of 5 stars.

) offers a dividend yield of 5.02% based on Thursday's closing price of $38.22 and the company's quarterly dividend payout of 48 cents. The stock is up 22% year-to-date. Dividend.com currently rates MO as “Recommended” with a DARS™ rating of 3.5 stars out of 5 stars.

Bloomberg

Bloomberg  AP

AP

Michael Dwyer/AP WASHINGTON -- The Supreme Court indicated Tuesday it won't offer much help to frequent flyers who want to sue when airlines revoke their miles or their memberships. The justices heard the case of a Minnesota rabbi who was stripped of his top-level "platinum elite" status in Northwest's WorldPerks program because the airline said he complained too much. Rabbi S. Binyomin Ginsberg said Northwest, since absorbed by Delta Air Lines (DAL), didn't act in good faith when it cut him off. The airline says the federal deregulation of the airline industry in 1978 rules out most lawsuits like the one filed by Ginsberg. Most justices signaled they think that ruling for Ginsberg could give rise to state-by-state rules that the deregulation law was intended to prevent. Justice Stephen Breyer said Ginsberg's complaint also could apply to airline ticket prices, which are supposed to be set through competition among airlines. "It sounds to me like I go in to, you know, get a ticket, my reasonable expectation is they're not going to charge me what they're going to charge, you know. I mean, it's unbelievable," Breyer said. Under Ginsberg's view of the case, Breyer said he could sue over the prices. "That might be a great idea, but I don't think that's the idea behind this act," he said. Ginsberg said in court papers that he and his wife flew almost exclusively on Northwest, logging roughly 75 flights a year to travel across the U.S. and abroad to give lectures and take part in conferences on education and administration. He said he flew on Northwest even when other airlines offered comparable or better flights and in 2005, reached the highest level of the WorldPerks program. Northwest cut him off in 2008, shortly after Northwest and Delta agreed to merge. Ginsberg said the move was a cost-cutting measure designed to get rid of the high-mileage customers. Northwest says Ginsberg complained 24 times in a 7-month period, including nine instances of luggage that turned up late on airport baggage carousels. Northwest said that before it took action, it awarded Ginsberg $1,925 in travel credit vouchers, 78,500 bonus miles, a voucher for his son and $491 in cash reimbursements. The airline pointed to a provision of the mileage program's terms that gives Northwest the right to cancel members' accounts for abuse. A federal trial judge cited earlier Supreme Court cases involving claims against frequent flyer programs in dismissing Ginsberg's lawsuit, including his claim that Northwest didn't live up to the terms of the contract. The judge said the contract gives the airlines the right to kick someone out of the mileage program at its "sole judgment." But the 9th U.S. Circuit Court of Appeals in San Francisco said part of the suit could go forward involving whether Ginsberg and others can sue under state laws that require parties to a contract to act in good faith. Justice Elena Kagan showed some sympathy for Ginsberg's claim when she questioned Paul Clement, the Washington lawyer representing Northwest at the Supreme Court. If the airline could easily avoid living up to its end of the bargain in the mileage program, Kagan said, "I don't think that I'd be spending all this time in the air on your planes. You know, I'd find another company that actually gave me the free ticket." Clement replied that Kagan's example shows that the free market, not a court, is the right place to address her problem. "So if some airline really were crazy enough to systematically turn on its most lucrative and loyal customers, surely, the market would solve that. And, of course, if a bunch of airlines did it, the Department of Transportation stands ready to police that," he said. Several justices questioned whether it is important to the case that many people earn and spend miles on items other than airline tickets. "Do we have to worry about that in this case?" Justice Samuel Alito asked. Adina Rosenbaum, Ginsberg's lawyer, told the court that the growth of mileage programs to encompass more than airline tickets is another reason to rule that Ginsberg's lawsuit is not blocked by the deregulation law. Breyer said the court perhaps could leave questions involving miles earned elsewhere "for another day." A decision is expected by late June. The case is Northwest Inc. v. Ginsberg, 12-462.

Michael Dwyer/AP WASHINGTON -- The Supreme Court indicated Tuesday it won't offer much help to frequent flyers who want to sue when airlines revoke their miles or their memberships. The justices heard the case of a Minnesota rabbi who was stripped of his top-level "platinum elite" status in Northwest's WorldPerks program because the airline said he complained too much. Rabbi S. Binyomin Ginsberg said Northwest, since absorbed by Delta Air Lines (DAL), didn't act in good faith when it cut him off. The airline says the federal deregulation of the airline industry in 1978 rules out most lawsuits like the one filed by Ginsberg. Most justices signaled they think that ruling for Ginsberg could give rise to state-by-state rules that the deregulation law was intended to prevent. Justice Stephen Breyer said Ginsberg's complaint also could apply to airline ticket prices, which are supposed to be set through competition among airlines. "It sounds to me like I go in to, you know, get a ticket, my reasonable expectation is they're not going to charge me what they're going to charge, you know. I mean, it's unbelievable," Breyer said. Under Ginsberg's view of the case, Breyer said he could sue over the prices. "That might be a great idea, but I don't think that's the idea behind this act," he said. Ginsberg said in court papers that he and his wife flew almost exclusively on Northwest, logging roughly 75 flights a year to travel across the U.S. and abroad to give lectures and take part in conferences on education and administration. He said he flew on Northwest even when other airlines offered comparable or better flights and in 2005, reached the highest level of the WorldPerks program. Northwest cut him off in 2008, shortly after Northwest and Delta agreed to merge. Ginsberg said the move was a cost-cutting measure designed to get rid of the high-mileage customers. Northwest says Ginsberg complained 24 times in a 7-month period, including nine instances of luggage that turned up late on airport baggage carousels. Northwest said that before it took action, it awarded Ginsberg $1,925 in travel credit vouchers, 78,500 bonus miles, a voucher for his son and $491 in cash reimbursements. The airline pointed to a provision of the mileage program's terms that gives Northwest the right to cancel members' accounts for abuse. A federal trial judge cited earlier Supreme Court cases involving claims against frequent flyer programs in dismissing Ginsberg's lawsuit, including his claim that Northwest didn't live up to the terms of the contract. The judge said the contract gives the airlines the right to kick someone out of the mileage program at its "sole judgment." But the 9th U.S. Circuit Court of Appeals in San Francisco said part of the suit could go forward involving whether Ginsberg and others can sue under state laws that require parties to a contract to act in good faith. Justice Elena Kagan showed some sympathy for Ginsberg's claim when she questioned Paul Clement, the Washington lawyer representing Northwest at the Supreme Court. If the airline could easily avoid living up to its end of the bargain in the mileage program, Kagan said, "I don't think that I'd be spending all this time in the air on your planes. You know, I'd find another company that actually gave me the free ticket." Clement replied that Kagan's example shows that the free market, not a court, is the right place to address her problem. "So if some airline really were crazy enough to systematically turn on its most lucrative and loyal customers, surely, the market would solve that. And, of course, if a bunch of airlines did it, the Department of Transportation stands ready to police that," he said. Several justices questioned whether it is important to the case that many people earn and spend miles on items other than airline tickets. "Do we have to worry about that in this case?" Justice Samuel Alito asked. Adina Rosenbaum, Ginsberg's lawyer, told the court that the growth of mileage programs to encompass more than airline tickets is another reason to rule that Ginsberg's lawsuit is not blocked by the deregulation law. Breyer said the court perhaps could leave questions involving miles earned elsewhere "for another day." A decision is expected by late June. The case is Northwest Inc. v. Ginsberg, 12-462.