Just as we examine companies each week that may be rising past their fair value, we can also find companies potentially trading at bargain prices. While many investors would rather have nothing to do with companies tipping the scales at 52-week lows, I think it makes a lot of sense to determine whether the market has overreacted to the downside, just as we often do when the market reacts to the upside.

Here's a look at three fallen angels trading near their 52-week lows that could be worth buying.

One lustrous investment

If you hadn't guessed by now, I'm a big fan of gold and gold miners. There are multiple factors at the moment that I feel could usher in another rally in gold prices. These include weak global economies, which make gold an attractive safe-haven investment; low domestic interest rates, which make gold attractive relative to low-yielding CDs and bonds; copious U.S. money printing, which could lead to inflation; and a contrarian mentality to buy when others are fearful. That's why I think investors would be foolish to pass up on cost-efficiency mining expert Goldcorp (NYSE: GG ) at its current levels.

Hot Gold Companies To Own In Right Now: Australian Dollar(AU)

AngloGold Ashanti Limited primarily engages in the exploration and production of gold. It also produces silver, uranium oxide, and sulfuric acid. The company conducts gold-mining operations in South Africa; continental Africa, including Ghana, Guinea, Mali, Namibia, and Tanzania; Australia; and the Americas, which include Argentina, Brazil, and the United States. It also has mining or exploration operations in the Democratic Republic of the Congo, Guinea, and Colombia. As of December 31, 2010, the company had proved and probable gold reserves of 71.2 million ounces. The company has a strategic alliance with Thani Dubai Mining Limited to explore, develop, and operate mines across the Middle East and parts of North Africa. AngloGold Ashanti Limited, formerly known as Vaal Reefs Exploration and Mining Company Limited, was founded in 1944 and is headquartered in Johannesburg, South Africa.

Advisors' Opinion: - [By Mel Daris]

AngloGold Ashanti (AU), a South African company, is trading for $33 and pays a dividend which yields 3.20%. The stock has an astonishing P/E of 1,015. Its net income totaled $112 million last year, but negative cash flows of $620 million. It holds net tangible assets of $4.3 billion and its balance sheet has not grown nearly as quickly as the other companies on this list. AngloGold has two new mines coming online in Congo and Colombia.

Hot Gold Companies To Own In Right Now: Claude Resources Inc.(CGR)

Claude Resources Inc. engages in the acquisition, exploration, and development of precious metal properties, as well as production and marketing of minerals in Canada. It primarily explores for gold in northern Saskatchewan and northwestern Ontario. The company holds interests in the Seabee gold mine located at Laonil Lake, northern Saskatchewan; and the Madsen property that consists of 6 contiguous claim blocks totaling approximately 10,000 acres, located in the Red Lake Mining District of northwestern Ontario. It also holds interest in the Amisk Gold project, which covers an area of 13,800 hectares in the province of Saskatchewan. The company was founded in 1980 and is based in Saskatoon, Canada.

Advisors' Opinion: - [By Christopher Barker]

Hardly a johnny-come-lately, Claude Resources initiated small-scale gold production from its flagship Seabee mine in Saskatchewan in 1991. Just last year, Claude added the Santoy 8 mine to that operation to offer a touch of timely growth. Meanwhile, the operation hosts a number of compelling exploration targets like the recently discovered Neptune zone. After 10 of 15 recent drill holes from Neptune featured visible gold, including a nice high-grade intercept of 84.66 g/t over 3.2 meters, prospects are building for Claude to add some additional years to this time-tested operation.

While I welcome the existing cash flow from Seabee, my investment thesis for Claude Resources centers around a pair of exciting exploration properties: the Amisk joint venture project southeast of Seabee and the Madsen property at Red Lake, Ontario. At Madsen, historical gold production between 1938 and 1976 yielded 2.4 million ounces at an average grade of 9 g/t. To date, Claude has identified an indicated resource of 928,000 ounces at a comparable grade. At Amisk, drill intercepts of eye-catching thickness suggest strong potential for a profitable open pit operation, including an intercept of 2.16 g/t over 241 meters! The deposit's 921,000 indicated gold-equivalent ounces represent only an early stage hint of the deposit's full potential. The stock is a top-10 holding for Sprott Asset Management, and a core holding for this Fool as well.

Agnico-Eagle Mines Limited, through its subsidiaries, engages in the exploration, development, and production of mineral properties in Canada, Finland, and Mexico. The company primarily explores for gold, as well as silver, copper, zinc, and lead. Its flagship property includes the LaRonde mine located in the southern portion of the Abitibi volcanic belt, Canada. The company was founded in 1953 and is based in Toronto, Canada.

Advisors' Opinion: - [By Vatalyst]

With headquarters in Canada, Agnico-Eagle is a gold producer that has been around for a while with operations in Canada, Finland and Mexico and the United States that has paid a cash dividend for 29 consecutive years. AEM gained 25% over the year and reported 83.5% growth in quarterly earnings. It has a market capitalization of $11.4 billion and a trailing P/E ratio of 34x with expectations of earning $0.55 per share. AEM, like other operators like it, are likely a better bet than ETF trust options like SPDR Gold Shares (GLD).

Hot Gold Companies To Own In Right Now: First Majestic Silver Corp.(AG)

First Majestic Silver Corp. engages in the production, development, exploration, and acquisition of mineral properties with a focus on silver in Mexico. The company owns interests in La Encantada Silver Mine comprising 4,076 hectares of mining rights and 1,343 hectares of surface land located in Coahuila; La Parrilla Silver Mine consisting of mining concessions covering an area of 69,867 hectares; and San Martin Silver Mine comprising approximately 7,841 hectares of mineral rights and approximately 1,300 hectares of surface land rights located in Jalisco. It also holds interests in Del Toro Silver Mine consisting of 393 contiguous hectares of mining claims and an additional 129 hectares of surface rights located in Zacatecas; Real de Catorce Silver Project comprising 22 mining concessions covering 6,327 hectares located in San Luis Potosi state; and Jalisco Group of Properties consisting of mining claims totalling 5,240 hectares located in Jalisco. The company was founded in 1979 and is headquartered in Vancouver, Canada.

Advisors' Opinion: - [By Goodwin]

The shares closed at $88.19, down $1.1, or 1.23%, on the day. Its market capitalization is $77.08 billion. About the company: Siemens AG manufactures a wide range of industrial and consumer products. The Company builds locomotives, traffic control systems, automotive electronics, and engineers electrical power plants. Siemens also provides public and private communications networks, computers, building control systems, medical equipment, and electrical components. The Company operates worldwide.

Hot Gold Companies To Own In Right Now: CME Group Inc.(CME)

CME Group Inc. operates the CME, CBOT, NYMEX, and COMEX regulatory exchanges worldwide. The company provides a range of products available across various asset classes, including futures and options on interest rates, equity indexes, energy, agricultural commodities, metals, foreign exchange, weather, and real estate. It offers various products that provide a means of hedging, speculation, and asset allocation relating to the risks associated with interest rate sensitive instruments, equity ownership, changes in the value of foreign currency, credit risk, and changes in the prices of commodities. CME Group owns and operates clearing house, CME Clearing, which provides clearing and settlement services for exchange-traded contracts and counter derivatives transactions; and also engages in real estate operations. Its primary trade execution facilities consist of its CME Globex electronic trading platform and open outcry trading floors, as well as privately negotiated transact ions that are cleared and settled through its clearing house. In addition, the company offers market data services comprising live quotes, delayed quotes, market reports, and historical data services, as well as involves in index services business. CME Group?s customer base includes professional traders, financial institutions, institutional and individual investors, corporations, manufacturers, producers, and governments. It has strategic partnerships with BM&FBOVESPA S.A., Bursa Malaysia Derivatives, Singapore Exchange Limited, Green Exchange, Dubai Mercantile Exchange, Johannesburg Stock Exchange, and Bolsa Mexicana de Valores, S.A.B. de C.V., as well as joint venture agreement with Dow Jones & Company. The company was formerly known as Chicago Mercantile Exchange Holdings Inc. and changed its name to CME Group Inc. in July 2007. CME Group was founded in 1898 and is headquartered in Chicago, Illinois.

Hot Gold Companies To Own In Right Now: Thompson Creek Metals Company Inc.(TC)

Thompson Creek Metals Company Inc., through its subsidiaries, engages in mining, milling, processing, and marketing molybdenum products in the United States and Canada. The company?s principal properties include the Thompson Creek Mine and mill in Idaho; a metallurgical roasting facility in Langeloth, Pennsylvania; and a joint venture interest in the Endako Mine, mill, and roasting facility in British Columbia. It also holds interests in development projects comprising the Davidson molybdenum property and the Berg copper-molybdenum-silver property located in northern British Columbia; the Howard?s Pass property, a lead and zinc project situated in the Yukon territory-northwest territories border; and the Maze Lake property, a gold project located in the Kivalliq district of Nunavut. The company produces molybdenum products, primarily molybdic oxide and ferromolybdenum, as well as soluble technical oxide, pure molybdenum tri-oxide, and high purity molybdenum disulfide. As o f December 31, 2010, its consolidated recoverable proven and probable ore reserves totaled 462.2 million pounds of contained molybdenum in the Thompson Creek Mine and the Endako Mine. The company was formerly known as Blue Pearl Mining Ltd. and changed its name to Thompson Creek Metals Company Inc. in May 2007. Thompson Creek Metals Company Inc. is based in Denver, Colorado.

Advisors' Opinion: - [By Christopher Barker]

My recent survey of bargain-basement stock valuations among gold miners identified Thompson Creek Metals as a glaring opportunity for value investors. The miner sports two world-class molybdenum mines with 534 million pounds of reserves between them, along with an array of attractive development projects in the pipeline. Foremost among those is the Mt. Milligan copper and gold project, where Thompson Creek expects to launch itself into the ranks of intermediate gold producers with production commencing in late 2013.

With 6 million ounces of gold reserves, accompanied by 2.1 billion pounds of copper, Mt. Milligan will deliver about 262,100 ounces of gold per year for the first six years of a 22-year mine life, averaging 194,500 ounces annually over that entire span. Although 25% of that gold production is already spoken for through a gold stream agreement with Royal Gold (Nasdaq: RGLD ) , Thompson Creek Metals is sure to enjoy a powerful cash-flow explosion.

Hot Gold Companies To Own In Right Now: NEW GOLD INC.(NGD)

New Gold Inc. engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties. The company primarily explore for gold, silver, and copper deposits. Its operating properties include the Mesquite gold mine in the United States; the Cerro San Pedro gold-silver mine in Mexico; and the Peak gold-copper mine in Australia. The company also has development projects, including the New Afton gold, silver, and copper project in Canada; and a 30% interest in the El Morro copper-gold project in Chile. The company was formerly known as DRC Resources Corporation and changed its name to New Gold Inc. in June 2005. New Gold Inc. was founded in 1980 and is headquartered in Vancouver, Canada.

Advisors' Opinion: - [By Christopher Barker]

This stock has set the gold standard for share price appreciation among gold miners, advancing more than 140% since I introduced Fools to the new face of New Gold back in January 2010. Looking out over the long-term horizon, New Gold has constructed a gorgeous development pipeline to complement its trio of producing gold mines, featuring: a low-risk 30% stake in Goldcorp's El Morro project in Chile, the New Afton copper and gold project in British Columbia (with production scheduled to begin mid-2012), and the recently acquired Blackwater project north of New Afton.

Although I expect the Blackwater deposit to expand considerably with further exploration, the project's initial indicated gold resource of 1.8 million ounces already leaves New Gold in command of 14.7 million ounces of measured and indicated gold resource. Tossing in copious supplies of by-product metals -- most notably 83.5 million ounces of silver and 3.5 billion pounds of copper -- New Gold is positioned to enjoy consistently low production costs throughout its sustained growth trajectory.

Hot Gold Companies To Own In Right Now: Newmont Mining Corporation(Holding Company)

Newmont Mining Corporation, together with its subsidiaries, engages in the acquisition, exploration, and production of gold and copper properties. The company?s assets or operations are located in the United States, Australia, Peru, Indonesia, Ghana, Canada, New Zealand, and Mexico. As of December 31, 2009, it had proven and probable gold reserves of approximately 93.5 million equity ounces and an aggregate land position of approximately 27,500 square miles. The company was founded in 1916 and is headquartered in Greenwood Village, Colorado.

FB data by YCharts

FB data by YCharts

), but went on to lower its price target for the company.Omotayo Okusanya, an analyst with the firm, cited that because the company’s portfolio of storage locations was virtually full, there was limited growth potential. Furthermore, Okusanya went on to comment about how Public Storage will have a hard time growing earnings even via acquisitions given its current size. As such, Jefferies reiterated a “Hold” rating on the stock and lowered its price target from $165 to $160 a share.

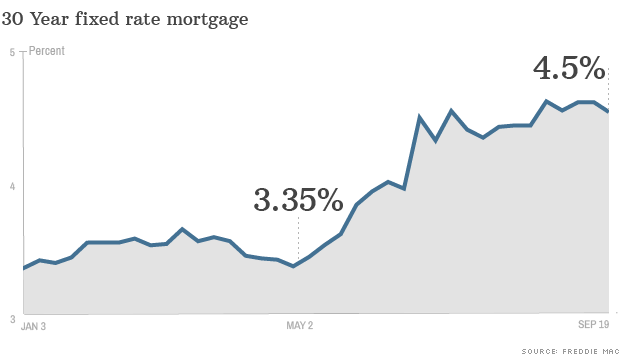

), but went on to lower its price target for the company.Omotayo Okusanya, an analyst with the firm, cited that because the company’s portfolio of storage locations was virtually full, there was limited growth potential. Furthermore, Okusanya went on to comment about how Public Storage will have a hard time growing earnings even via acquisitions given its current size. As such, Jefferies reiterated a “Hold” rating on the stock and lowered its price target from $165 to $160 a share. NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

.jpg)