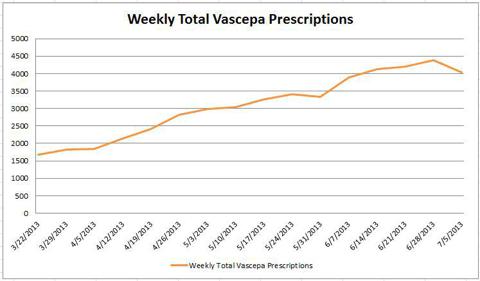

In the week ended 7/5/13, Vascepa scripts took their biggest weekly regression to date. I tackled the topic of script growth slowing in my last article "Vascepa Scripts: Cyclical Growth or Slowdown?" -- but now we're looking at some legitimate regression in total scripts. What's going on here?

From its website, "Amarin (AMRN) Corporation is a biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health. Amarin's product development program leverages its extensive experience in lipid science and the potential therapeutic benefits of polyunsaturated fatty acids. Vascepa (icosapent ethyl) is Amarin's first FDA approved product and is available in the United States by prescription."

(Click to enlarge)

After the drug's approval, the company failed to produce any major pharmaceutical partners, brought on its own sales staff, and is taking a stab at launching Vascepa on its own. In the face of the stock losing a good portion of its value over the past six months, prescription data (provided by Symphony and IMS Health) continues to head in the right direction.

Here is data for total prescriptions, as of the most current data citing 7/5/13. You can notice the biggest week over week dip in total prescriptions where the data is most current.

(click to enlarge)

From 6/28/13 to 7/5/13, the number of scripts went from 4380 back down to 4043 -- a decrease of 337 scripts and -7.69%. If the next week's data comes in lower than 4380, it'll be the first time the company has regressed from a high for more than one week. The microscope is going to be on continued data going forward from here.

I'll say that I'm still bullis! h on Amarin, but these numbers continue to give me pause; script data for this company has always been "adequate," not the grand slam that investors have been expecting. In terms of catalysts coming down the pipe for the company, there's a couple.

The first immediate catalyst is going to be the continuation of prescription data coming in. Vascepa has never seen two weeks in a row of regression, and data of that magnitude is sure to have a negative effect on the stock -- should it occur.

Then, we have earnings coming up in August. Almost just as important as the data that management is going to offer up to shareholders is going to be the way in which they've done it. In the past, AMRN executives have failed to make any type of forward guidance for Vascepa, including estimates on prescriptions going forward. Two earnings calls ago, it was stated that they would do so "once they've had a chance to gather some initial data." I would say that the time for it is now -- when the stock faces unease and investor confidence isn't exactly through the roof.

SA Contributor Biotech Will is predicting an earnings beat:

Predicted Q2 2013 Earnings (dollars in thousands excluding EPS)

Prescriptions | Revenue | Product Cost | Net Profit/Loss | EPS / diluted |

46,757 | $10,431 | $5,735 | $(58,516) | $(0.39) / (0.34) |

Analysts are currently estimating a loss of $0.40 p/s, but as you can see from the above table, even using a conservative model, Amarin should beat these expectations and instead report a non-diluted loss of $0.39 p/s, or after the ADSs issuance and dilution, a loss of $0.34 p/s (not including any potential option exercise by underwriters), and again ignoring any decrease in cost of goods.

Aside from the quarterly results and management's editorialization of them in t! he confer! ence call, there's a binary event coming down the pipe in a few months. Biotech Will weighs in on something I've talked about in my past few articles -- the lead up to the October ADCOM meeting:

The eventual pricing of the offering at $5.60 p/s helped to stabilize the stock price somewhat, and now many investors are looking forward to several upcoming catalysts, including the October FDA Advisory Panel on the Supplemental New Drug Application for the so-called ANCHOR indication, the Prescription Drug User Fee Act (PDUFA) date of December 20, 2013, and the potential buy-out or partnership with 'Big Pharma' that many investors are anxiously awaiting.

QTR's Analysis

I contend that the trade here is still bullish. As long as the script data can hold its own, Amarin is bound to rise leading up to October through December. It's simply the nature of biotech stocks -- leading up to major decisions, we often see biotechs rise on emotion of investors wanting to get in for the "big score."

The data (like the study from last week) doesn't exactly scare me -- yet. Making a trend out of it would be a different story, however.

Again, I'll restate my caveats that could easily shift me back to a bearish stance on the company:

Prescription data slows dramatically week-over-week (or total prescriptions continue to regress in any facet) -- I'm going to be keeping an extremely close eye on week over week numbers. It's the lifeblood of the entire company and extremely important that data continues to trend upward.The company reports a cash burn that is equivalent to last quarter's -- it needs to get its spending under control now that the launch is no longer in its beginning stages.Prescription data winds up being a continued major product of discounts, giveaways and samples -- we need the data that we're seeing to be as true as possible.Continued media and medical study that begins to consistently show that fish oil shows no benefit/does more harm than good.Again, I currently ha! ve no pos! ition in Amarin, but am still bullish here. I covered my short and am now watching from the sidelines. I wish all investors, long or short, the best of luck.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment