WageWorks (WAGE) is a leading provider of tax-advantage programs for consumer-directed benefits ("CDBs") in the US. The company operates and administers a wide range of tax-advantage CDBs including health and dependent care Flexible Spending Accounts ("FSAs"), Healthy Savings Accounts ("HSAs"), Health Reimbursement Arrangements ("HRAs"), as well as commuter benefits. WageWorks' CBD programs allow employees to save tax money by using pre-tax earnings to pay for their healthcare and commuter expenses. The programs also enable employers to benefit from reduced payroll taxes as their contributions are deductible for tax purpose, even after factoring in WageWorks' service fees.

WageWorks has approximately 27,000 employer clients and a total of about 2.8 million employee participants. The company delivers its CBD programs and services through an internet website which is programmed with an on-demand feature and can be accessed from any internet-enabled devices used by both employers and employees. The company's product and service distribution channels include direct sales to business (i.e. employer clients), brokerage (e.g. insurance companies) sales to business, as well as direct sales to affiliated groups or channel partners.

In fiscal 2012, WageWorks generated approximately 64% of its total revenue from heath and dependent care CDB programs, 29% from commuter benefit solutions, and 7% from various other CDB plans.

Stock Overview

WageWorks went IPO in May 2012 and share price has steadily appreciated by almost 300% since then (see chart below), resulting in a market capitalization of approximately $1.7B. At ~$50, the stock is trading slightly off from its all-time high at $56.97. Based on the next 12-month consensus EPS estimate of $0.76, the current share price implies a forward P/E multiple of 65.4x.

(click to enlarge)

Financial Overview

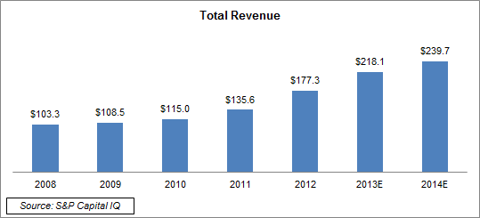

Over the past 5 fiscal years, WageWorks' revenue has increased from $103.3M in 2008 to $177.3M in 2012, representing a CAGR of 14.5%. The historical top line growth was primarily driven by organic growth, portfolio purchases, and tuck-in acquisitions. Going forward, consensus estimates suggest that the growth may continue at a CAGR of 16.5% over 2013 and 2014 and the revenue would reach $239.7M by then (see chart below).

(click to enlarge)

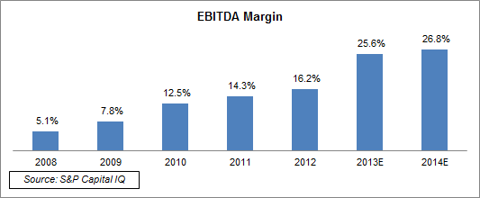

EBITDA margin expanded from 5.1% in 2008 to 16.2% in 2012 primarily driven by high operating leverage. As WageWorks is completing the integration process for its past acquisitions, consensus estimates predict the EBITDA margin to further rise to 26.8% by 2014 (see chart below).

(click to enlarge)

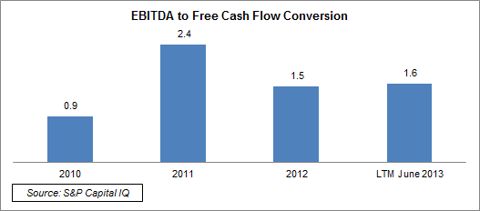

The company is cash-rich. In the past 3 fiscal years, the firm was able to convert on average 1.6x of its annual EBITDA into levered free cash flows (see chart below). As of June 2013, WageWorks had $355.0M cash balance and only carried $44.4M debt, representing a net cash position of $310.6M, or about 18.2% of the current market capitalization.

(click to enlarge)

Industry Tailwind

Healthcare FSA was authorized in 1978. Under the legislation, employers can offer a healthcare benefit program that allows employees to set aside a portion of their pre-tax earnings for potential healthcare, vision, dental and dependent care expenses. HRA legislation was enacted in 1980, this account allows employers to contribute a specific amount of available reimbursement funds to help their employees defray out-of-pocket medical expenses (e.g. deductibles), and su! ch contri! butions are deductible for employers' tax calculation and tax-free for employees. In 2003, a Medicare Act established HSA which shares a lot of similarities with HRA. A variety of commuter benefit programs has been enacted since 1998 to provide employees tax incentives to use public transportation. The commuter benefit plans work similarly to FSA as they allow employees to set aside pre-tax earnings for commuting expenses.

There are a few secular trends that are expected to drive substantial growth of tax-advantage CDB service industry over a long run. First of all, Healthcare costs to for both employers and employees are expected to continue rising. According to a Kaiser Family Foundation Survey in 2012, premiums for employer-sponsored healthcare programs have increased by more than 100% over the past 10 years. A study from Aon Hewitt suggests that employers would expect healthcare program premiums to increase by another 6.3% in 2013. Further, the study also predicts that employees' out-of-pocket healthcare expenses are expected to rise by 13.4% in 2013 as employers have been passing the higher costs to employees by increasing their cost sharing of the healthcare programs (e.g. higher deductibles). Owing to that trend, according to an Employee Benefit Research Institute report in 2013, the total number of FSA accounts has increased to 35 million since its authorization in 1978 with penetration rate being at around 24% for all eligible employers in the country, suggesting a large growth potential as more employers elect to adopt tax-advantage CDB programs. The total number of HSA and HRA accounts has also increased substantially from 1.3 million in 2006 to 11.6 million in 2012.

Secondly, due to rising commuter costs and increasing social responsibility awareness (i.e. environmental damage) among corporations, the commuter benefit programs were created to encourage carpooling, cycling, and use of public transportation. According to a 2012 report from American Public Transportation Association! , althoug! h the US population has grown by 6% since 2005, the country's public transit travel has increased by 12% over the period and there has been no growth in highway travel. As gas price continues to trend up, it is expected that more employees would utilize public transit, hence supporting the growth of the commuter benefit programs. By the end of 2012, the penetration rate of the commuter benefits was only 30% and approximately 70% of the US employers do not offer any commuter benefits, implying a large market opportunity.

Further, the legislation and rules related to the implementation and administration of the tax-advantage CDB programs are complex and constantly changing. Compliance failure would result in program disqualification and penalties, suggesting a high administration costs for employers. Given the complexity of the programs, employers typically require in-depth data analysis to maximize the plan value by optimizing employee participation. They also need to provide their employees with professional education programs to effectively help them understand the benefits and increase participation level. As such, the additional cost burden has spurred substantial demand for CDB programs and related services provided by external professional firms such as WageWorks.

The tax-advantage CDB market is highly fragmented as most of the programs and related services are provided by large companies engaging in insurance, payroll service, and human resource consulting businesses with CDB services being a non-core offering. As such, the lack of focus on CDB business essentially limits the breadth and quality of these large companies' offerings. There are also numerous small third party administrators ("TPAs") offering CDB administration services. However, given their small operation scale, these players are typically lack of financial and technology resources to rapidly response to regulation changes which are critical for CDB product development. As such, these industry characteristics have presen! ted a tre! mendous opportunity for professional CDB providers to seize market share by offering industry-leading programs and services and consolidating small players.

Competitive Advantages

Being a leading provider of tax-advantage CDB programs and services, WageWorks bears a few competitive edges that would enable the company to continue expanding market share. Given the company's core business is to provide a comprehensive range of CDB programs and related services, the firm's financial and technology resources are dedicated to develop and improve its CDB offerings which tend to be superior to the services offered by small competitors or large firms with non-core focus on CDBs. For example, WageWorks' on-demand website provides its employer clients with strong data and reporting capabilities in managing their benefit programs. The website also offers employee participants direct access to their personal accounts which display historical records such as claims, transaction, and balance as well as support online claim submission. Further, owing to the on-demand feature, the website can be tailored to meet different needs from employer clients and accessed through various platforms including desktop PCs, tablets, and mobile devices. The CDB-focused strategy has in return enabled WageWorks to gain more comprehensive understanding of client needs and thus provide higher quality and more innovative CDB products and solutions to clients.

The highly scalable technology infrastructure (e.g. the service website) has also enabled WageWorks to attract clients of any sizes, from SMEs to global firms. Its enterprise client portfolio is now consisted of 50 of the Fortune 100 companies and 183 of the Fortune 500 companies from various industry verticals including manufacturing, technology, financial services, media, transportation, retail, and healthcare. Such diversified client base effectively mitigates the firm's exposure to industry-specific cycle and volatility, enhancing top line stability. In terms of ! client co! ncentration, WageWorks' 10 largest employer clients generated only 12.5% of the total revenue in 2012 and no single client accounted for more than 5% of the total sales.

WageWorks' client services are considered to be among the best in the industry. The company has been focusing on providing employee participants with timely and accurate responses to their inquiries, claims, and other account related concerns. The company's client service department is able to process 99% of client claims within 2 business days, answer 88% of client calls within 30 seconds, and complete all the calls within an average of 16 seconds, which are substantially above industry standards.

WageWorks has a stable financial model as the company typically signs three-year term agreement with large enterprise clients and one to three-year contracts with small accounts. In each of 2010, 2011, and 2012, WageWorks' recurring revenue (i.e. revenue generated from the same clients) accounted for more than 90% of its total revenue, indicating a high top line visibility.

Aside from organic growth, WageWorks has also been actively pursuing acquisition opportunities. Since 2007, the company has made 1 tuck-in acquisition and 6 CDB portfolio purchases, and management has demonstrated their superior capabilities in executing transactions at right prices and integrating business operations.

Growth Strategies

Management currently employs a few strategies aiming to capitalize on the industry's fast growing trend. WageWorks has been trying to promote employee participation within its current employer client base by marketing the company's CDB program offerings through various professional training sessions. Given that the company's average employee participation rate is only at 26%, it is believed that there remains a substantial room for further participation improvement.

In addition, management has also been focusing on increasing employer penetration rate for its various tax-advantage CDB offerings through cr! oss selli! ng. As many of WageWorks' clients are still using one type of the company's CDB programs, management believes the cross-sell opportunity to be significant.

To further boost organic growth, management markets the products and services through multiple sales channels. The company's enterprise sales force typically maintains relationship with large enterprise clients and attracts large client contracts through employer referral, consulting relationship, and strategic partnership. In terms of small clients, WageWorks generally relies on a broker network (e.g. insurance companies) to gain client exposure. Management believes that there are more growth opportunities with small clients due to the large number of small businesses in the US and lower CDB penetration rate for this group.

The fragmented CDB industry landscape has presented a significant consolidation opportunity for professional CDB providers like WageWorks. Management intends to grow the client base through CDB portfolio purchases and has announced a target of making 1-3 acquisitions per year. The company has already identified 400 potential candidates with annual revenues ranging from $5M to $25M and will continue evaluating additional opportunities to ensure a healthy pipeline of potential acquisition targets. The rich cash balance and strong cash generating capability has provided the company sufficient firepower to pursue acquisitions.

Current Development

In early August, WageWorks reported its Q2 results which exceeded consensus expectations. Quarterly revenue rose by 25% from $43.8M in Q2 2012 to $54.6M in Q2 2013 primarily driven by a strong 11% organic growth and acquisitions. Adjusted EBITDA margin came in at 27.3%, up by 2.6% from 24.7% in Q2 2012 owing to strong operating leverage. Normalized EPS in the quarter was $0.20, representing a 33% year-over-year growth.

In the earnings call, management indicated that new contract wins continued to be solid as the company has added 5 Fortune 500 employer clients s! o far in ! 2013. Management believes that the company's IPO in 2012 has significant raised its profile in the CDB market and better positioned the company to attract new businesses. Management also confirmed that the company has been on track with its acquisition objective of completing 1 to 3 deals per year. It is noted that WageWorks acquired Crosby Benefit Systems in May 2013 and the business integration is well on track.

In addition, management announced a new marketing channel partnership with Ceridian. The deal includes a $15M portfolio purchase of Ceridian's tax-advantage CDB portfolio and a partnership agreement whereby Ceridian would assist selling WageWorks' CDB products and services to its client base. Management expects to realize $9M to $11M annual revenue starting in late 2013 from this agreement and some incremental margin expansion as WageWorks would be able to utilize Ceridian's resources to market its CDB products.

In addition, the company announced that it has contracted with Tower Watson to exclusively provide administration services for its healthcare exchange's HSAs and HRAs. Given that potential penetration rate for private healthcare exchange would likely exceed the current average of 25% for general industries thanks to favorable regulatory ruling, this opportunity would likely to provide a significant business upside for WageWorks as the company builds its reputation in the healthcare exchange field.

Valuation

WageWorks' valuation has risen significantly over the past 12 months as the stock's forward P/E ratio has increased by 94% from 33.7x to 65.4x (see chart below).

(click to enlarge)

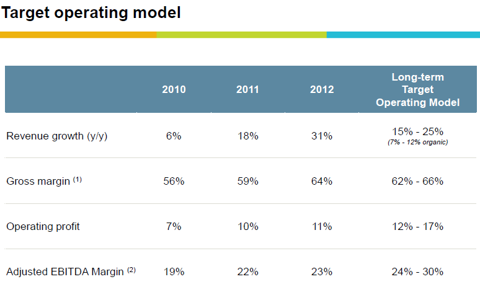

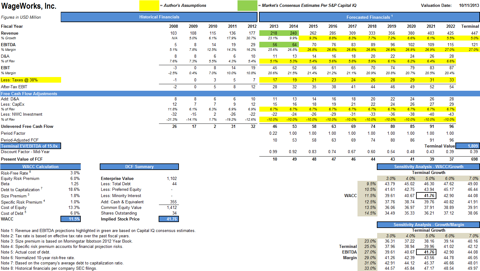

Given WageWorks' strong free cash flow generation, I employed a DCF model to test the margin of safety on the valuation. It is noted that management has established a 15% to 25% long-term (i.e. 5 years) revenue growth target for the company ! with appr! oximately 7% to 12% coming from organic growth (see chart below). They also expect the EBITDA margin to stay within the range from 24% to 30%. Given that it is impossible to forecast incremental cash flows brought by future M&A activities, my DCF analysis only modeled an organic growth scenario with the following key assumptions incorporated:

(click to enlarge)

Source: Company Presentation

Street's consensus revenue estimates for 2013 and 2014 were used and the revenue growth rate was assumed to decelerate from 9.9% in 2014 to 5.0% in terminal year, which still implies a 7.4% CAGR throughout the projection horizon.Street's consensus EBITDA margin estimates for 2013 and 2014 were used and the margin was assumed to trend up slightly to 27.0% in terminal year, which is the mid-point of management's target range.Other cash flow related assumptions including depreciation and amortization, capital expenditure, net working capital investment, and tax expense were forecasted based on their average relationship to total revenue in the past 3 years.As the company's growth will eventually slow down as the industry becomes matured, the stock's valuation will likely decrease accordingly. Hence, I assumed a terminal forward EV/EBITDA multiple of 15.0x, which is below the current level at 22.0x. The forward EV/EBITDA multiple was then used to project the company's value in terminal year.I calculated WageWorks' WACC to be 11.5%, which was based on current company and market data.(click to enlarge)

Based on the above fair estimates, my model yields a stock value of $41.75, which is 20% below the current market price at ~$50, assuming all future growth is organic (see chart above). This also suggests that market currently ascribes approx! imately 2! 0% of the share price to future M&A activities, which appears to be aggressive and leaves limited margin of safety.

From a relative perspective, the stock also looks expensive. As there are no directly comparable comps for WageWorks, I opted to compare the stock's valuation to that of the general market. WageWorks is currently trading at 65.4x forward P/E multiple, which is substantially above S&P 500's average of 14.7x. One may argue that this is due to WageWorks' robust growth potential. According to consensus estimates, the company's EPS is expected to grow at 16.7% over a long run while the average long-term EPS growth for S&P 500 companies is forecasted to be 8.5%. This suggests that WageWorks' long-term PEG ratio of 3.9x is more than twice of S&P 500's PEG ratio at 1.7x.

Let's be creative and compared WageWorks' valuation to those of online social network stocks, which typically bear rich valuations. Currently, WageWorks is trading at 8.5x forward P/Sales multiple, which is notably below those of Facebook (FB) and Linkedin (LNKD) at 19.5x and 21.4x, respectively. However, consensus estimates suggest that WageWorks' revenue is likely to grow at CAGR of 16.3% over 2013 and 2014 compared to Facebook and Linkedin's estimated revenue CAGR of 39.1% and 48.5%, respectively, over the same period. By incorporating the revenue growth estimates to the P/Sales valuation metrics, WageWorks' PSG ratio of 0.52x is slightly above Facebook's 0.50x and Linkedin's 0.44x. In terms of long-term PEG ratio, WageWorks' figure of 3.9x is substantially above Facebook and Linkedin's 2.0x and 2.4x, respectively, reflecting that market's enthusiasm on the CDB provider is even richer than many of the online social network leaders.

Conclusion

WageWorks is riding on a very strong fundamental owing to its leading market position in the CDB industry that is currently experiencing secular growth. However, I believe the market has overreacted to this growth story and the stock appears to be ov! erpriced ! now. If you are not a momentum trader but instead believe in value investing, I would recommend to wait for a lower entry point at around $40 or consider selling out-of-money put options.

All facts and data used in the article are sourced from S&P Capital IQ, company SEC filings, conference call transcripts, and company presentation unless otherwise specified.

Source: WageWorks: Fundamentals Are Compelling But Valuation Looks LoftyDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment